iPhone 13 PTA Tax With Passport iPhone 13 Pro Expert Max PTA Tax Expense

- Introduction to iPhone 13 and iPhone 13 Pro Max

- Apple’s Impact in the Pakistani Market

- Understanding PTA Tax in Pakistan

- iPhone 13 and iPhone 13 Pro Max Prices

- Implications of PTA Tax on iPhones

- How to Calculate PTA Tax

- Registering Your iPhone with PTA

- PTA Tax Payment Procedure

- Tax Exemptions and Special Cases

- Common Misconceptions About PTA Tax

- Benefits of Purchasing an Official iPhone

- The Role of Warranty and After-Sales Services

- Customer Feedback and Experiences

- Conclusion: Making Informed Choices

- FAQs on iPhone 13 PTA Tax

- 13 Pro Expert Max PTA Tax Expense

iPhone 13 PTA Tax With Passport

| Models | Tax on Passport |

|---|---|

| iPhone 13 | Rs118,380 |

| iPhone 13 mini | Rs113,665 |

| iPhone 13 Pro | Rs133,158 |

| iPhone 13 Pro Max | Rs137,873 |

iPhone 13, iPhone 13 Expert Max PTA Expense in our Pakistan

Introduction to iPhone 13 and iPhone 13 Pro Max

The iPhone 13 and iPhone 13 Pro Max are the latest additions to Apple’s prestigious lineup. These smartphones have generated significant buzz worldwide, including in Pakistan, where they’ve become a status symbol and a symbol of technological innovation.

Apple’s Impact in the Pakistani Market

Apple’s iPhones have gained immense popularity in Pakistan due to their quality, performance, and brand reputation. The company has successfully carved a niche in the market and created a dedicated fan base.

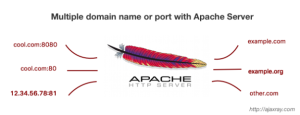

Understanding PTA Tax in Pakistan

In Pakistan, the Pakistan Telecommunication Authority (PTA) imposes a tax on mobile devices to ensure their legal usage and to combat illegal imports. This tax applies to all mobile phones, including the iPhone 13 and iPhone 13 Pro Max.

iPhone 13 and iPhone 13 Pro Max Prices

The prices of these iPhones can vary, with the Pro Max being more expensive. However, it’s important to note that the final cost includes the PTA tax.

Implications of PTA Tax on iPhones

PTA tax can significantly impact the overall cost of the iPhone. Understanding how this tax is calculated is crucial for potential buyers.

How to Calculate PTA Tax

PTA tax is calculated based on the mobile device’s value, including freight and insurance charges. This amount is then subjected to a fixed percentage.

Registering Your iPhone with PTA

To ensure legal usage, all iPhones must be registered with the PTA. This process is straightforward but mandatory.

PTA Tax Payment Procedure

Once you’ve calculated the tax, you need to pay it through designated channels, ensuring your iPhone complies with regulations.

Tax Exemptions and Special Cases

Certain individuals may be eligible for tax exemptions or reductions, such as overseas Pakistanis or those returning after an extended period.

Common Misconceptions About PTA Tax

Many myths surround PTA tax, which can confuse buyers. We’ll debunk some common misconceptions.

Benefits of Purchasing an Official iPhone

Officially purchased iPhones come with warranties and after-sales services, ensuring your device’s longevity and performance.

The Role of Warranty and After-Sales Services

Exploring the importance of warranties and post-purchase support, which are vital for your iPhone’s maintenance.

Customer Feedback and Experiences

Real-life experiences from iPhone users in Pakistan who have dealt with the PTA tax.

Conclusion: Making Informed Choices

Summarizing the key points and emphasizing the importance of being well-informed when purchasing an iPhone in Pakistan.

FAQs on iPhone 13 PTA Tax

- What is PTA tax, and why is it imposed on mobile devices?

- How can I calculate the PTA tax for my iPhone?

- Are there any exemptions for PTA tax on iPhones?

- What is the warranty period for official iPhones in Pakistan?

- Can I register my iPhone with PTA after purchase?